The only resource you need to become an expert on chargebacks, customer disputes, and friendly fraud.

Download the Guide100% Free Download | Instant Access

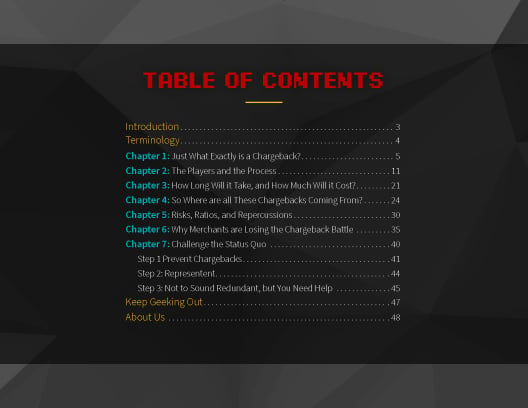

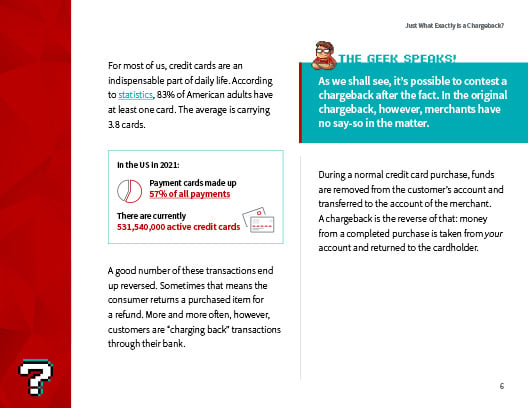

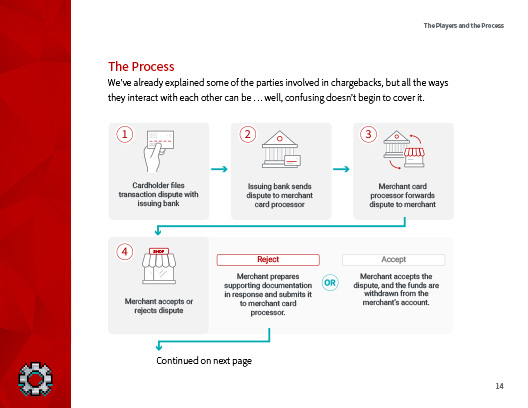

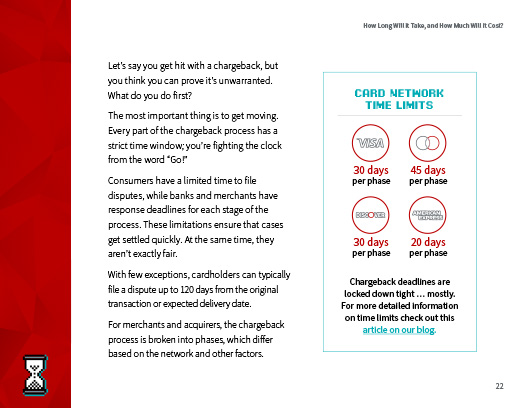

What chargebacks are, why they happen, who all is involved, and how merchants can fight back.

What happens if merchants receive too many disputes? What are chargeback ratios? Do they matter?

Why merchants are losing the fight against “cyber shoplifting” and chargeback fraud.

The chargeback world has a language all its own. Luckily, the geeks at Chargebacks911 speak fluent chargeback-ese, and we’ve created a resource that translates all that tech-y terminology into everyday language. Full of expert advice and insider tips, this guide explains everything you need to be a chargeback genius.